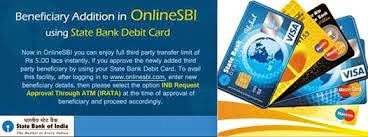

To minimize internet banking frauds,

majority of the Banks have a cooling period before funds can be remitted to a

new beneficiary through net banking.

A balance between safety and

customer delight can increase the inte

rnet banking volumes.

Towards this end, State Bank of

India has introduced the IRATA mode.

The IRATA mode was introduced in

April 2014, however at present it is being marketed extensively.

The full form of IRATA is “Internet Banking

Request Approval Through ATM”.

The full limits of INR5.00lacs can be

enjoyed instantly, if the newly added third party beneficiary is approved through

the IRATA mode.

This facility can be availed through a very

simple process. Just select the option Approval through ATM (IRATA) at the time

of approval of beneficiary in the online sbi module and proceed accordingly.

The principles of 3 factor authentication

are applied in IRATA:-

Factor 1 – What you have (ATM Card)

Factor 2 – What you know (ATM Password)

Factor 3 – What you know (10-digit INB

reference number)

Another beneficiary for the SBI group is

the higher utilization rate for its ATMs.