EPFO and NPS – Competition better for the customers.

What is EPFO ?

EPFO stands for Employee Provident Fund Organisation.

The Employees' Provident Fund, India Head office is at

Location : 14, Bhikaiji Cama Place

Bhavishya Nidhi Bhawan,

New Delhi-110 066

e-mail : cpfc@epfindia.gov.in

The Constitution of India under "Directive Principles of State Policy" provides that the

State shall within the limits of its economic capacity make effective provision

- for securing the right to work,

- to education

- and to public assistance in cases

- of unemployment,

- old-age,

- sickness &

- disablement and undeserved want.

The EPF & MP Act, 1952 was enacted by Parliament and came into force with effect from 14th March,1952.

A series of legislative interventions were made in this direction, including the Employees' Provident Funds & Miscellaneous Provisions Act, 1952.

The Employees' Provident Fund Organisation, India

Extracted from the Website of EPFO

Main features of the New Pension System: -

Main Features and Architecture of the New Pension System

- The new pension system would be based on defined contributions. It will use the existing network of bank branches and post offices etc. to collect contributions. There will be seamless transfer of accumulations in case of change of employment and/or location. It will also offer a basket of investment choices and Fund managers. The new pension system will be voluntary.

Extracted from the PFRDA Website.

Recent news articles have pointed out that due to increased competition from NPS (National Pension Scheme), EPFO is in the process of transforming its customer service department.

The main features in its proposed customer service initiatives are

01) Updating the Mobile numbers of its subscribers. This will enable EPFO to inform its subscribers of any important changes pertaining to their account. The most important being the credit of their PF amount to their Bank Account.

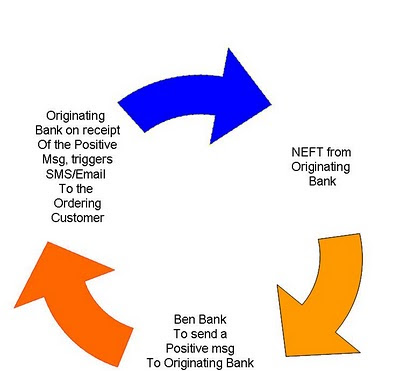

The next and most electrifying initiative is to gradually move to NEFT (National Electronic Funds Transfer) for its payments to its account holders, instead of the old fashioned paper cheques.

As of 26/04/2010, 95 Banks with their 67,354/- branches are part of the NEFT network.

This constitutes 95% of Indian Bank Branches, excluding the Co-operative Banks and Regional Rural Banks. So a large majority of the EPFO customer’s Bank accounts are under the ambit of the NEFT.

This is stimulating news for the growth of Volumes of NEFT and is an important step for achieving the 70%-30% dream of NPCI in the Indian Retail Payments scenario.

I foresee the following benefits that EPFO and the Indian Banking System, will accrue on switching over from the paper based cheques to NEFT

01) Faster delivery of the customer’s funds to their respective bank accounts.

02) Faster reconcialtion of transactions, as the NEFT transactions have to be credited at T+2 Batch settlement or Returned to the Beneficiary.

03) Reduced carbon print due to the reduction in paper cheques.

04) Huge spurt of NEFT Volumes.

05) New converts to ePayments, as the EPFO employees and EPFO account holders will be familiar with the benefits of NEFT.

The below table highlights the number of member claims settled by EPFO.

| | MEMBERS CLAIMS SETTLED | |||

| 2006-07 | 2007-08 | 2008-09 | ||

| No. of Claims ( In Lakhs) | No. of Claims ( In Lakhs) | No. of Claims (In lakhs) | ||

| Provident Fund Claims | 25.76 | 29.30 | 34.73 | |

| Partial Withdrawal/ Advances | 3.59 | 3.33 | 3.22 | |

| Transfer Cases | 2.16 | 2.30 | 2.80 | |

| Monthly Pension Claims (MPC) | 3.63 | 3.54 | 4.10 | |

| Employees' Pension Claims (all other benefits) | 19.29 | 20.95 | 26.59 | |

| E.D.L.I Claims | 0.20 | 0.21 | 0.20 | |

| Total | 51.00 | 56.09 | 71.64 | |

This means 70lacs + transactions can immediately be part of the NEFT Cycle.

It can be observed that the number of claims settler every year is on the increase.

However, for this customer service initiative to be successful, EPFO should initially do a mass cleaning up exercise.

After the initial exercise, it is better the cycle be followed every six months or at least yearly, to shave its customer’s bank account numbers up to date.

Currently the EPFO has 5 crores subscribers spread over all over India

As this number is very large, EPFO can concentrate on the 10 cities to clean up the Bank Account Numbers and gradually cover all its subscribers.

I suggest the following process flow:

01) Collate the Top 10 cites EPFO subscribers list.

02) Write to them, that EPFO is switching over to NEFT and hence request for the Bank Account numbers along with the IFS Codes.

03) Once 80% + of the subscribers respond, initiate a Re1/- dummy transaction, to the subscribers accounts through the NEFT.

04) In case of success, update appropriately in the EPFO software package.

05) In case of failure, inform the subscriber accordingly.

This exercise to be repeated every year.

OR,

If the above is cumbersome and costly, another option is

01) Compile the Subscribers list Bank Wise.

02) Filter the list to only NEFT Participant Banks.

03) Prepare individual bank list with complete particulars.

04) Forward the list to the respective controlling Bank office, with a request to inform the valid account numbers and also their respective IFS Codes.

05) Follow up only with those subscribers, whose bank accounts are invalid.

The above is a more simple way.

Last not but the least, the switching over from physical cheques to NEFT, is a golden opportunity for IT Companies to be part of a major IT project.